tn franchise and excise tax exemption

Hello Fellow BPers As a fairly new Tennessee LLC we received a final notice from Tennessee Department of Revenue requesting 646 for Franchise and Excise taxes and late fees. This blog series will cover certain aspects of Tennessees Franchise and Excise tax and give particular focus to the more common exemptions available under the taxing.

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller

Apply for exemption from state taxes.

. This blog is a continuation of discussion Part 1 posted on 83021 on the various exemptions. Make quarterly estimated payments. Franchise and Excise Taxes 1 Dear Tennessee Taxpayer This franchise and excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of.

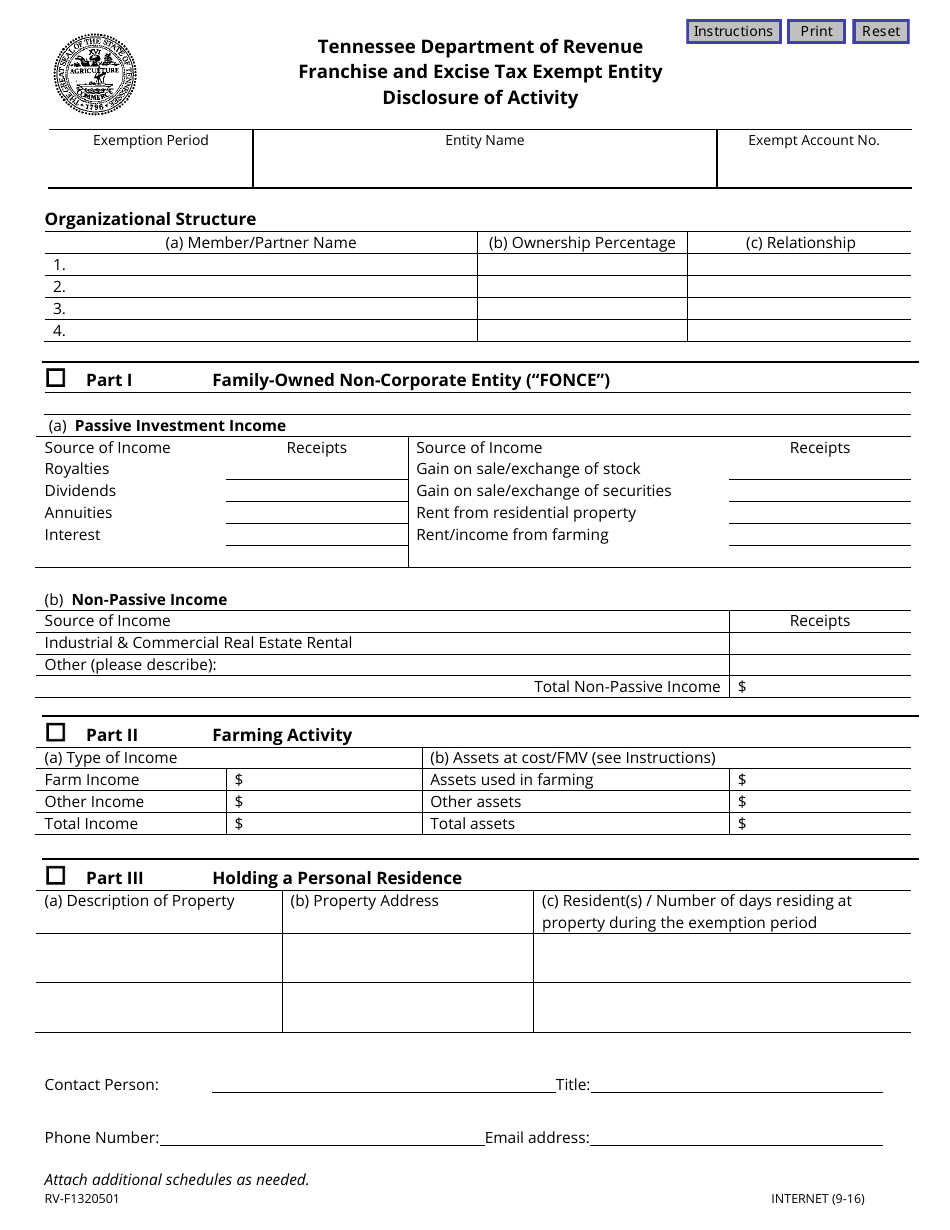

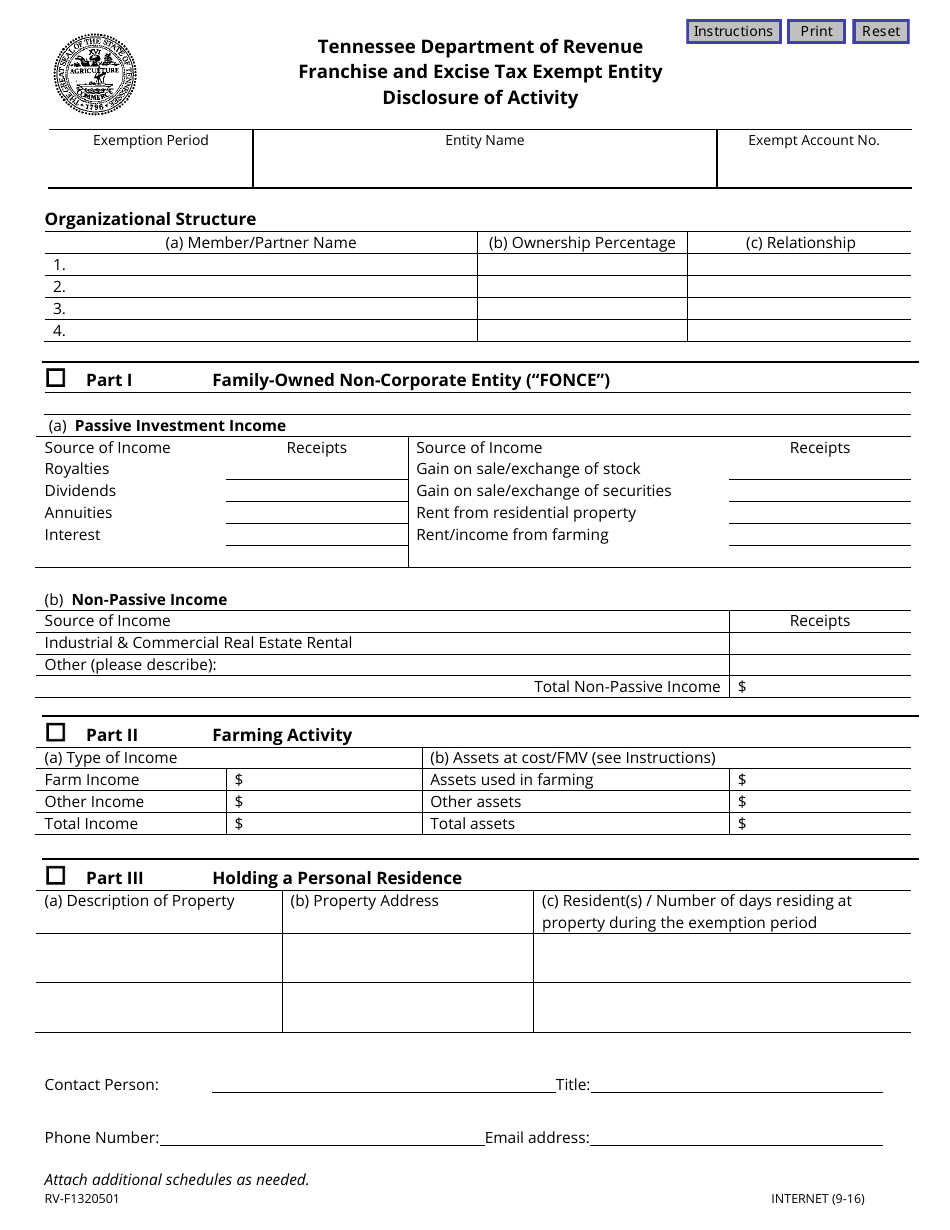

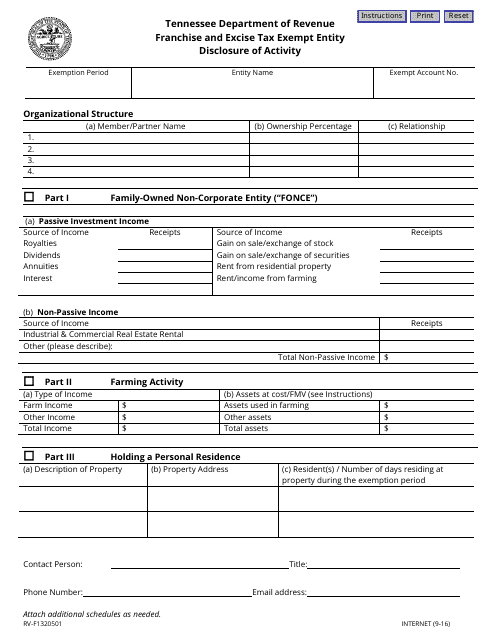

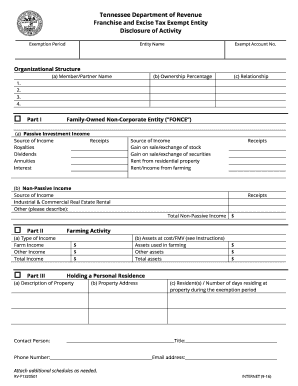

Tennessee Code Annotated Section 67-4-2008 provides exemption from Tennessees Franchise and Excise Taxes under certain situations. Download or print the 2021 Tennessee Form FAE-Disc Franchise and Excise Tax Exempt Entity Disclosure of Activity for FREE from the Tennessee Department of Revenue. Excise Tax Deductions for COVID-19 Relief Payments.

To qualify for the franchise and excise tax venture capital fund exemption the venture capital fund must be a limited liability company limited liability partnership limited. FE-9 - Extension for Filing the Franchise and Excise Tax Return. Franchise and excise tax.

Tennessee Franchise Excise Tax Part II January 20 2022 - 6 minutes read. 65 excise tax on the net earnings of the entity and. Application of Wholesale Gallonage Tax to Winery Direct Shippers.

Ad Fill Sign Email FAR 183 More Fillable Forms Register and Subscribe Now. Tennessee Department of Revenue Attention. FONCE-5 - The Definition of Passive Investment.

67-4-2008 a6iiiiii Internal Revenue Code 26 US. The form on the reverse side should be completed. If you have questions about Franchise And Excise Tax Online contact.

Code 280A d2 Entity is an LLC LP or LLP At least sixty-six and sixty-seven hundredths percent. FONCE-4 - The FONCE Exemption When No Income Was Generated. Franchise.

Ad Upload Modify or Create Forms. State income tax exemption. 67-4-2008a11 is made.

Franchise Excise Tax - Excise Tax. As a nonprofit your organization will be exempt from paying corporate income tax state franchise. You can search for your account number for the following tax types on Tennessee Taxpayer Access Point TNTAP.

The excise tax is based on net earnings or. Important Notice Posted. FONCE-3 - Entity Types That May Qualify for the FONCE Exemption.

To receive a six month extension a taxpayer must have paid on or before the original due date an amount. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee.

All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business. All entities doing business in Tennessee and having a substantial nexus in. Important Notice 09-05 Annual Renewal of Franchise and.

Tennessee Department of Revenue. Make an extension payment. Essentially the determination of whether the Taxpayer is exempt for Tennessee franchise and excise tax purposes pursuant to TENN.

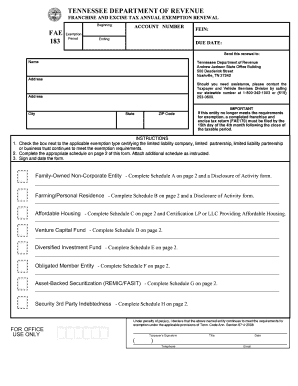

TENNESSEE DEPARTMENT OF REVENUE RV-R0012201 1121 Franchise and Excise Tax Application for ExemptionAnnual Exemption Renewal FAE 183 Check all that apply. The Tennessee Franchise and Excise tax has two levels. File a franchise and excise tax return for an entity that only owes the 100 minimum franchise tax.

025 per 100 based on either the fixed asset or equity of the. Use e-Signature Secure Your Files. Save Time Signing Documents from Any Device.

Ad Download Or Email FAR 183 More Fillable Forms Register and Subscribe Now. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Try it for Free Now.

Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242.

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Form Fae 183 Franchise And Excise Tax Annual Exemption Renewal Due The 15th Day Of The Fourth Month Following The Close Of Your Books And Records

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

Form Rv F1320501 Download Fillable Pdf Or Fill Online Franchise And Excise Tax Exempt Entity Disclosure Of Activity Tennessee Templateroller

Tennessee Franchise And Excise Tax Exemption Fill Online Printable Fillable Blank Pdffiller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tn Fae 170 Instructions Fill Out And Sign Printable Pdf Template Signnow

Form Fae 183 Franchise And Excise Tax Annual Exemption Renewal Due The 15th Day Of The Fourth Month Following The Close Of Your Books And Records

Form Rv F1320501 Download Fillable Pdf Or Fill Online Franchise And Excise Tax Exempt Entity Disclosure Of Activity Tennessee Templateroller

Standard Form 1402 Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Fae 183 Franchise And Excise Tax Annual Exemption Renewal Fae 183 Franchise And Excise Tax Annual Exemption Renewal Fax Email Print Pdffiller

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Franchise Excise Tax Exemptions Farming Or Personal Residence Youtube